United Kingdom Carer’s Allowance: A Comprehensive Guide

United kingdom carer’s allowance Overview

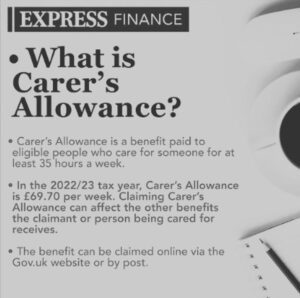

The United Kingdom Carer’s Allowance is a crucial government initiative designed to provide financial support to individuals who dedicate their time and effort to caring for someone with a disability or illness. This allowance recognizes the invaluable service provided by carers and offers extra financial assistance to help them meet the challenges associated with caregiving responsibilities.

Carer’s Allowance is an essential component of the broader support system in the UK, aiming to ease the financial burden on those selflessly caring for their loved ones. This introduction sets the stage for understanding the various aspects, eligibility criteria, and benefits associated with the United Kingdom Carer’s Allowance.

- Purpose: Financial support for individuals caring for someone with a disability or illness.

- Benefits:

- Extra money for caregiving services.

- Opportunity to earn extra money.

- Weekly allowance of £67.25 directly deposited into the recipient’s bank account.

Eligibility Criteria and Application Process

- Criteria:

- Certain criteria must be met.

- State pension age and valid national insurance number required.

- Evidence of caring responsibilities to prevent benefit fraud.

- Claims Procedure:

- Apply through the official government website or UK Carer’s Allowance service.

- Provide accurate information and supporting evidence.

- Documents needed include proof of identity and details about the person being cared for.

Impact on Other Benefits

The nature of the program is means-tested, indicating eligibility is based on financial need, though it may affect other benefits without undergoing means testing itself. Additionally, it is regarded as income for tax credits, influencing the calculation of tax-related benefits. In terms of interaction with the State Pension, participation in the program may have repercussions on credits linked to the State Pension, subject to age considerations and residence tests.

Contact and Fraud Prevention

- Contacting Authorities:

- Contact the local Department for Work and Pensions office.

- Utilize the official government website for information.

- Fraud Prevention Measures:

- Implementing measures to prevent fraud.

- Positive feedback received from clients.

Understanding United Kingdom Carer’s Allowance

- Nature of the Service:

- Support payment for carers in the UK.

- Financial assistance for caregiving.

- Fraud Awareness:

- Benefit fraud is a serious offense.

- Legal consequences for fraudulent claims.

- Contacting Authorities:

- Crucial to contact relevant authorities for accurate information.

- Ensures appropriate benefit receipt.

Eligibility and Additional Information

- Qualifying for UK Carer’s Allowance:

- Eligibility based on providing care for at least 35 hours per week.

- Affected by benefits received by the person being cared for.

- Impact on Other Benefits:

- Affects Housing Benefit, Pension Credit, and Tax Credits.

- Clear understanding needed before making changes to benefit claims.

Additional Considerations for Carer’s Allowance

Residence tests rely on providing evidence of one’s residence to determine eligibility. Hospital stays and utilization of support services can potentially affect eligibility for the program. The calculation of earnings is a pivotal factor for the United Kingdom Carer’s Allowance, where income exceeding the weekly threshold can impact the allowance payment.

Allowance Entitlement

- Age Considerations:

- State pension age plays a significant role.

- Specific requirements for those who have reached state pension age.

- Residence Tests and Benefits Interaction:

- Interaction with certain benefits and credits.

- Understanding factors impacting eligibility and financial support.

Claiming United kingdom Carer’s Allowance

- Support Payment Purpose:

- Financial support payment for carers.

- Eligibility based on providing care for someone receiving a qualifying benefit.

- National Insurance Credits:

- Entitlement to National Insurance credits.

- Protects future entitlements for those not currently working.

Application Process and Backdating Claims

When completing the application form for the UK Carer’s Allowance, individuals can access it online or through the designated service. It is crucial to provide accurate information along with supporting evidence. For those considering backdating claims, it’s possible for up to three months, requiring evidence of entitlement during that period.

In the event of disputing decisions, steps are available to challenge them, and seeking impartial help and advice is recommended. Understanding the entitlement criteria is essential to ensure fair and accurate decisions regarding claims. Lastly, in cases of suspected fraudulent activity, prompt reporting through appropriate channels is encouraged to maintain the integrity of the program.

Changes in Circumstances

- Impact of Changes on Carer’s Allowance Entitlement:

- Changes in circumstances can significantly affect Carer’s Allowance entitlement.

- Carers must understand how changes impact benefits.

- Prompt reporting of changes is crucial for continued receipt of the allowance.

- Impact of Disabled Person’s Benefits on Carer’s Allowance:

- Certain benefits received by the disabled person may affect the United Kingdom Carer’s Allowance entitlement.

- Means-tested or income-related benefits received by the disabled person can impact eligibility.

- Some benefits have an underlying entitlement requirement, potentially reducing or eliminating the United Kingdom Carer’s Allowance.

- Preventing Fraud and Overpayment:

- Reporting changes promptly is essential to prevent fraud and overpayment.

- Includes changes in earnings or entitlement to other benefits.

- Ensures correct United Kingdom Carer’s Allowance amount and avoids issues with underpayment or overpayment.

Reporting Requirements and Consequences:

Carers are advised to promptly report changes in earnings and benefits to avoid incorrect benefit payments. It is crucial to be aware of reporting requirements, and in case of uncertainty, carers can seek assistance from the United Kingdom Carer’s Allowance Unit. The unit offers impartial guidance on reporting, ensuring carers understand their responsibilities and have accurate information about entitlements.

While the Carer’s Allowance itself is not considered as income for tax credits or certain benefits, earnings and other income sources may impact the supplement. Awareness of these factors is essential. Moreover, receiving the Carer’s Support Payment may affect eligibility for housing benefit and council tax reduction, emphasizing the need for carers to stay informed to ensure correct entitlements and prevent benefit issues.

Entitlement to Extra Money through Pension Credit:

- Receiving carer’s allowance may entitle individuals to extra money through pension credit.

- Additional financial support for carers dedicating time and efforts to caregiving.

- Provides much-needed assistance to carers.

Additional Benefits and Interactions

- Impact on Housing Benefit:

- carer’s allowance may affect housing benefit.

- Housing benefit is a means-tested benefit assisting with rent payments.

- Receipt of United kingdom carer’s allowance can influence eligibility or payment amounts.

- Influence on Other Entitlements:

- carer’s allowance interaction with other benefits needs understanding.

- Awareness of potential changes in entitlements is crucial.

- Consideration of state pension options and their impact on entitlements.

- State Pension and National Insurance Contributions:

- State pension age determines when pension payments begin.

- Carers receiving United kingdom carer’s allowance still accumulate national insurance contributions.

- Entitlement to state pension continues during United Kingdom Carer’s Allowance receipt.

Pension Choices and Other Benefit Impact:

Choices regarding pensions have a significant impact on overall income, necessitating consideration of how other benefits may affect the total amount received. It is crucial to be aware of the interactions between the United Kingdom Carer’s Allowance, pensions, and various income sources. Pension Credit, designed for individuals at state pension age, offers additional income, housing benefit, and council tax reduction, with eligibility determined by factors such as income, savings, and partnership status.

National Insurance credits earned during the United Kingdom Carer’s Allowance contribute to state pension entitlement, ensuring continued pension contributions during caregiving. Additionally, the integration of Universal Credit has implications for those receiving the Carer’s Allowance, tax credits, and Pension Credit, highlighting the importance of understanding how these elements interact. National insurance credits also play a role in the integration of Universal Credit.

Entitlement and Housing Support under Universal Credit:

- United kingdom carer’s allowance receipt may impact entitlement and housing support.

- Seeking impartial help and guidance is essential.

- Understanding changes in individual circumstances under Universal Credit.

- Qualifying Benefit: Pension Credit:

- Pension Credit offers financial support at state pension age.

- Additional income, housing benefit, and council tax reduction benefits.

- Eligibility based on factors like income, savings, and partnership status.

- Continued Pension Contributions:

- National insurance credits earned during United kingdom carer’s allowance contribute to state pension.

- Ensures ongoing pension contributions while providing care.

- Informed Decision-Making for Carers:

- Understanding interactions between United kingdom carer’s allowance, benefits, and pensions.

- Informed decisions about financial situations and accessing available support.

- Awareness empowers carers to navigate complexities effectively.

Specifics for Scotland Residents

- Caring for multiple individuals in the United Kingdom is challenging for carers, involving responsibilities at home, in hospitals, or care homes.

- The demands of caring for multiple individuals can be physically and emotionally overwhelming.

- Carers have access to impartial help and support services to manage their responsibilities effectively.

- These services offer guidance, advice, and practical assistance to navigate the complexities of caregiving.

- Financial support is available through the carer element in Universal Credit, recognizing carers’ contributions and easing financial burdens.

- Housing benefit is another form of financial support covering rent or mortgage payments for qualifying carers.

- The amount of allowance depends on factors like earnings, income from other sources, and entitlement to qualifying benefits.

- Carers providing care for more than one person may be eligible for additional support allowance.

- Understanding the impact of tax credits and pension credit on carer’s allowance is crucial for eligibility and payment amounts.

- Shared caring responsibilities, involving family members or professional caregivers, can lighten the burden on individual carers.

- Impartial help and support services guide carers on effectively sharing caregiving duties to ensure everyone involved receives the necessary care.

Providing Care for Multiple Individuals

Caring for multiple individuals poses significant challenges for caregivers, who must navigate responsibilities across various settings, including homes, hospitals, or care facilities, leading to both physical and emotional strain. Fortunately, support services provide impartial help, guidance, and practical assistance to help caregivers manage their responsibilities effectively.

Financial support, such as the carer element in Universal Credit and housing benefit, acknowledges caregivers’ contributions and eases their financial burdens. Eligibility for housing benefit is based on specific criteria linked to caregiving responsibilities.

The United Kingdom Carer’s Allowance amount depends on earnings, income, and entitlement to qualifying benefits, with additional support allowance available for caregivers of multiple individuals. Understanding the impact of tax credits and Pension Credit on the Carer’s Allowance is crucial, influencing both eligibility criteria and payment amounts.

Shared caregiving, involving family members or professional caregivers, plays a vital role in supporting both caregivers and recipients, lightening the burden on individuals. Impartial help and support services offer guidance on effectively sharing caregiving responsibilities to ensure all involved individuals receive the necessary care.

Ineligibility and Compliance Issues

- Eligibility Criteria for Carer’s Allowance:

- Meeting certain criteria is essential to qualify for the United Kingdom Carer’s Allowance .

- Ineligibility can result from not meeting the qualifying benefit criteria.

- Understanding and meeting the necessary requirements is crucial.

- Compliance Issues:

- Non-compliance with rules and regulations can lead to civil penalties.

- Benefit fraud is a serious concern.

- Failure to report changes in earnings or benefits can cause overpayments and penalties.

- Impartial Help Sources:

- Disabled persons can access impartial help to understand entitlements.

- Guidance on eligibility requirements and support during the application process is available.

- These resources help navigate complexities related to United Kingdom Carer’s Allowance .

National Insurance Contributions and Tax Credits:

- National Insurance contributions impact entitlement to benefits, including Carer’s Allowance.

- Tax credits received by carers may affect eligibility for the allowance.

- Both factors contribute to determining eligibility.

- Correct Calculation and Reporting:

- Incorrect calculations can lead to overpayments and penalties.

- Accurate information during the application process is crucial.

- Overpayments may impact other benefits like tax credits or pension credit.

- Reporting Changes Promptly:

- Promptly reporting changes in circumstances is essential.

- Prevents potential penalties or overpayment issues in the future.

- Ensures correct entitlement to benefits.

- Fraud Prevention Measures:

- Various measures in place to prevent fraud related to United Kingdom Carer’s Allowance payments.

- Benefit fraud is a serious offence with severe consequences.

- Government provides impartial help to prevent fraud and ensure benefits reach those genuinely in need.

- Accurate Information and Evidence:

- Crucial to provide accurate information and evidence during the application process.

- Prevents misunderstandings or future issues.

- Following guidelines and reporting changes promptly ensures correct entitlement without unnecessary penalties or overpayments.

Support Options for United Kingdom Carer’s Allowance

The United Kingdom Carer’s Allowance is a financial payment designed to support caregivers in the UK, particularly those caring for individuals with disabilities. This allowance offers essential financial assistance to help cover the costs associated with caregiving.

The Carer Element, integrated into Universal Credit, provides additional funds specifically for caregivers of disabled individuals, helping to address extra expenses related to their responsibilities. Housing Benefit is another supportive component that assists caregivers with accommodation costs, thereby easing the financial burden associated with living arrangements, particularly for those requiring adjustments or larger homes for caregiving purposes.

It’s important to note that receiving the Carer’s Allowance may have implications for pension choices and contributions, making impartial help and advice crucial for making informed decisions about financial matters.

Additional Financial Support:

- Carers may be eligible for tax credits and other forms of support.

- Various forms of financial assistance are available to ease caregiving costs.

- Navigating Financial Support:

- Process may be overwhelming, but impartial help is available.

- Guidance on eligibility, application processes, and benefits available.

- Aims to ensure caregivers receive all entitled assistance.

- Allowance Payments:

- Carers may receive allowance payments or extra money through certain benefits.

- Direct payments into a bank account to support caregiving responsibilities.

- Accessing Help and Advice:

- Services available to provide information on benefits and support allowances.

- Impartial help on eligibility, application processes, and related queries.

- Covers a range of topics, including housing benefit and care home options.

- Empowering Carers:

- Services empower carers to make informed decisions.

- Knowledge about available support options.

- Ensures they access the financial assistance needed for caregiving.