Get the best deals on discount title loan with trusted providers. Find local services for your title loan needs. Apply now and save!

Discount title loan

How They Work

Discounted Rates for Title Loans

Lower Interest Rates

Discount title loan, Title loans offer discounted rates to borrowers. These reduced rates are based on the borrower’s credit history. For those with a good credit score, lenders often provide lower interest rates as an incentive.

Borrowers can benefit from special promotions when applying for a title loan for the first time. Lenders may offer discounts or promotional rates to attract new customers. This can result in significant savings on interest payments over the life of the loan.

Flexible Repayment Options

Title loan lenders typically provide flexible repayment options, allowing borrowers to choose terms that suit their financial situation best. With discounted rates available, borrowers have more leeway in managing their repayments while saving money on interest costs.

- Pros:

- Lower interest rates based on credit history.

- Special promotions for first-time applicants.

- Flexible repayment options with discounted rates.

- Cons:

- Discounts may vary depending on the lender and individual circumstances.

Local Title Loan Services

Local Title Loan Services

Quick Access

Local discount title loan services provide a swift way to secure cash by using your vehicle as collateral. This type of service is especially handy for individuals facing urgent financial needs. Borrowers can access the funds within hours, making it an ideal solution during emergencies.

Title loan providers in your area offer a convenient and hassle-free process to obtain the needed money promptly. By leveraging your vehicle’s value, you can quickly address unexpected expenses or financial gaps. These services cater to those who require immediate cash without undergoing lengthy approval processes.

Flexible Repayment

One significant advantage of local discount title loan services is the flexibility they offer in terms of repayment options. Unlike traditional loans, these providers often customize repayment plans based on individual circumstances. This personalized approach ensures that borrowers can manage their payments effectively without undue stress or strain.

Trusted Title Loan Providers

Competitive Interest Rates

Trusted discount title loan providers are known for offering competitive interest rates, making them an attractive option for borrowers. These lower rates can result in significant savings over the life of the loan, compared to other lending options. By choosing a reputable provider with favorable interest rates, borrowers can minimize their overall repayment amount.

Some key benefits include:

- Lower total repayment amount

- Reduced financial burden on the borrower

- Increased affordability and flexibility in managing repayments

Transparent Application Process

One distinguishing feature of trusted title loan providers is their transparent and straightforward application process. Borrowers appreciate clarity when applying for loans, as it helps them understand the terms and conditions better. With clear guidelines and requirements laid out by these providers, applicants can navigate the application process with ease.

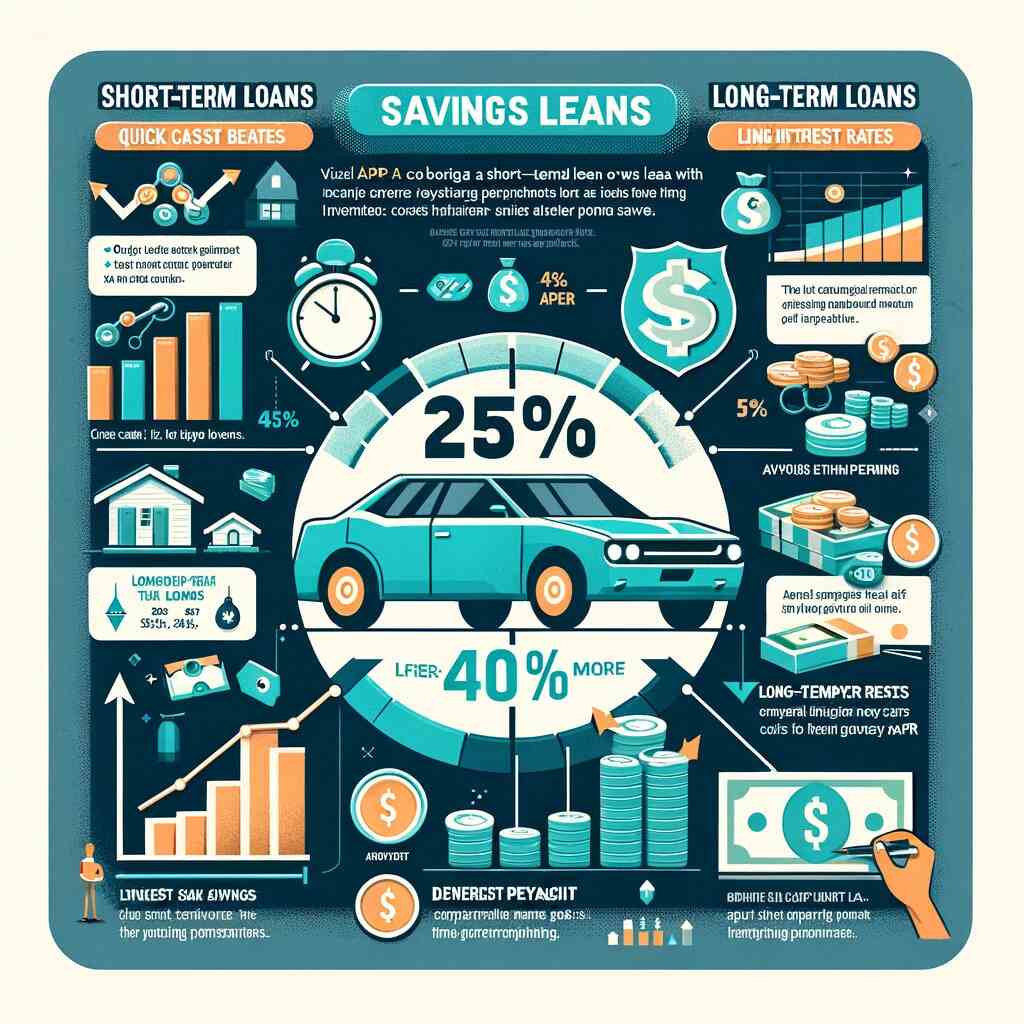

Short Term Loan Savings

Short Term Loan Savings

Lower Interest Rates

Short term loans, such as discount title loans, often come with lower interest rates compared to long-term options. This means that you pay less in interest over the life of the loan. For example, a discount title loan may have an annual percentage rate (APR) of 25%, while a traditional long-term loan could have an APR of 40% or more.

Discount title loans are designed to be short-term solutions for financial emergencies. By opting for this type of loan, you can access quick cash without committing to a lengthy repayment period. This allows you to address immediate financial needs without accumulating substantial long-term debt.

Avoiding High Interest Costs

One significant advantage of discount title loans is the ability to pay off the loan quickly and avoid high-interest costs. Since these loans are typically short in duration, you can repay them faster than traditional long-term loans, reducing the total amount paid in interest. For instance, if you borrow $1,000 through a discount title loan and repay it within two months at an APR of 20%, you would pay significantly less in interest compared to spreading out payments over several years.

Automatic Payments for Title Loans

Automatic Payments for Title Loans

Timely Payments

Setting up automatic payments for your discount title loan ensures you never miss a payment deadline. This helps you avoid incurring late fees and additional penalties.

Automating your title loan payments is a convenient way to stay on top of your financial obligations. By having the funds automatically deducted from your account, you can focus on other aspects of managing your finances without worrying about missing payments.

Financial Planning

With automatic payments, you can simplify your financial planning by knowing exactly when the funds will be debited from your account each month. This predictability allows you to budget more effectively and ensure that there are sufficient funds available for repayment.

Understanding Car Title Loans

Understanding Car Title Loans

How Discount Title Loans Work

Discount title loans are a type of car title loan where the borrower’s vehicle is used as collateral. The loan amount is usually a percentage of the car’s value, and repayment terms typically last for about 30 days.

Car owners in need of quick cash can use their vehicle titles to secure short-term loans. These loans often come with high-interest rates, sometimes exceeding triple digits annually. While they provide fast access to funds, borrowers should be cautious about the potential financial risks involved.

- Quick access to cash

- No credit check required

- Can borrow up to a percentage of the car’s value

- Repayment term usually around 30 days

Risks Associated with Discount Title Loans

Failure to repay discount title loans on time can lead to severe consequences. If borrowers default on payments, lenders have the right to repossess their vehicles. Due to the high-interest rates charged on these loans, borrowers may find themselves trapped in a cycle of debt if they cannot repay them promptly.

Local Title Loan Services

Local Title Loan Services Short Term Loan Savings

Short Term Loan Savings Automatic Payments for Title Loans

Automatic Payments for Title Loans Understanding Car Title Loans

Understanding Car Title Loans